French Nuclear Power Availability and its Effect on Energy Prices

French Nuclear Power Availability and its Effect on Energy Prices

Current French Nuclear Outages

France has a long history of nuclear power use and is one of the world’s largest producers of nuclear energy. As of 2021, around 75% of France’s electricity is generated by nuclear power. French Nuclear Output is currently at a 6-year low. Almost half of France’s 56 reactors are shut down due to corrosion problems and maintenance. Stress corrosion, which produces microscopic cracks, was found in four sites near the welds on pipes of cooling circuits which are crucial for shutdowns or accidents. As a precaution, other similar reactors were pre-emptivley shut down to allow inspections to be carried out. 30GW is due to come back online by February, however, the issue with this is that recently EDF has extended many outages past the date they were due to come back online.

Importance of French Nuclear Power Plants

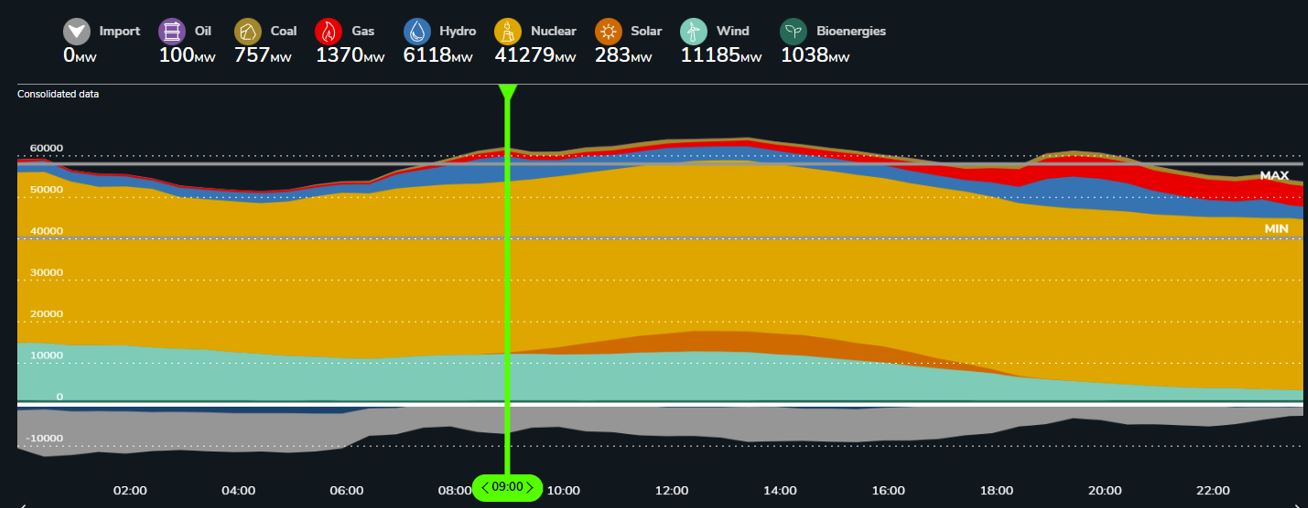

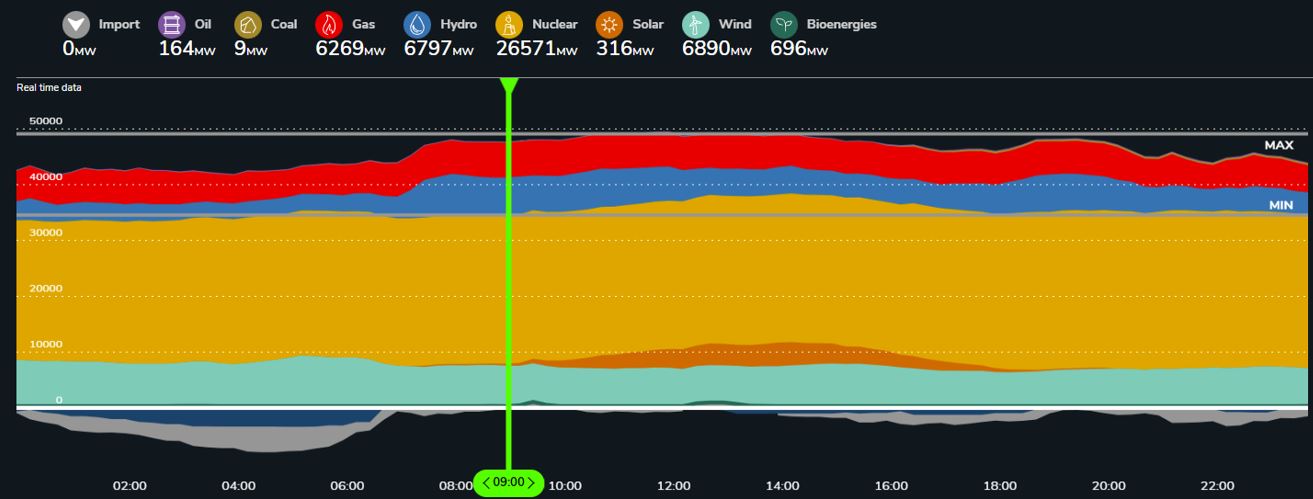

Nuclear generation typically accounts for 25% of the EU’s total electricity production, France produces just over half of this generation. Figure 1. and Figure 2., taken from RTE the French transmission system operator’s website, show the power generation by energy source on the 21st of October 2021 at 9 am and exactly a year later on the 21st of October 2022 at 9 am again. In Figure 1. , Nuclear generation accounted for 66% of power generation, however in Figure 2. it only accounted for 56%, an increase in gas and hydro generation was needed here to fulfil demand. Notably, in Figure 1., at 9 am France was exporting over 7GW of generation to neighbouring interconnected countries.

To help put this figure in context, the average demand for the entire island of Ireland is around 5GW. On the 21st of October 2022 at 9 am, France was exporting a disproportionally low amount, thus showing the effect that these outages not only have on France but on other neighbouring interconnected countries.

- Figure 1. 21st October 2021

- Figure 2. 21st October 2022

Energy Economics Study “Do nuclear power plant outages in France affect the German electricity prices”

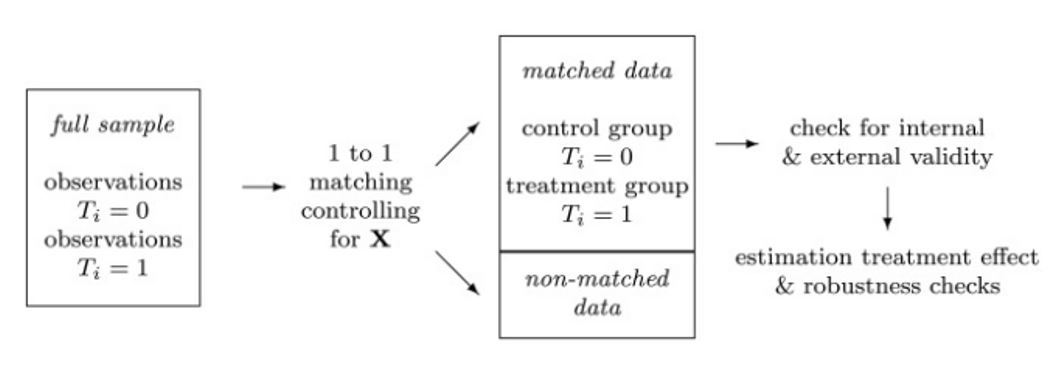

A study analysing if nuclear outages in France affect German electricity prices was published in 2019. It had two aims which were to identify the effect of outages on the French electricity spot market price and to investigate whether the shock was passed onto the German spot market through cross-border trade. The study analysed the period between October 2016 – February 2017 when 20% of the French nuclear power plant capacity was unavailable at short notice due to the safety of steam generators.

- Figure 3. Do nuclear power plant outages in France affect the German electricity price

Study Results

Results from the study indicate that the French electricity spot market price increased by 27.1% or 17.42€/MWh due to the outages. The German-Austrian electricity spot market price was affected in two ways. Increased exports from Germany to France caused the German spot market price to increase by 3.2% or 1.36€/MWh. Decreased imports from France to Germany increased the German spot market price by 7.6% or 3.22€/MWh.

The decrease in imports from France had the most significant effect on the German spot market price, as France is usually a net exporter to other countries. Bear in mind that these percentage increases in price would be much higher in monetary terms today given much higher power prices, also during this study only 20% of the fleet was unavailable and currently around 50% of the fleet is unavailable.

Analysis of French Nuclear Power Plant Outages

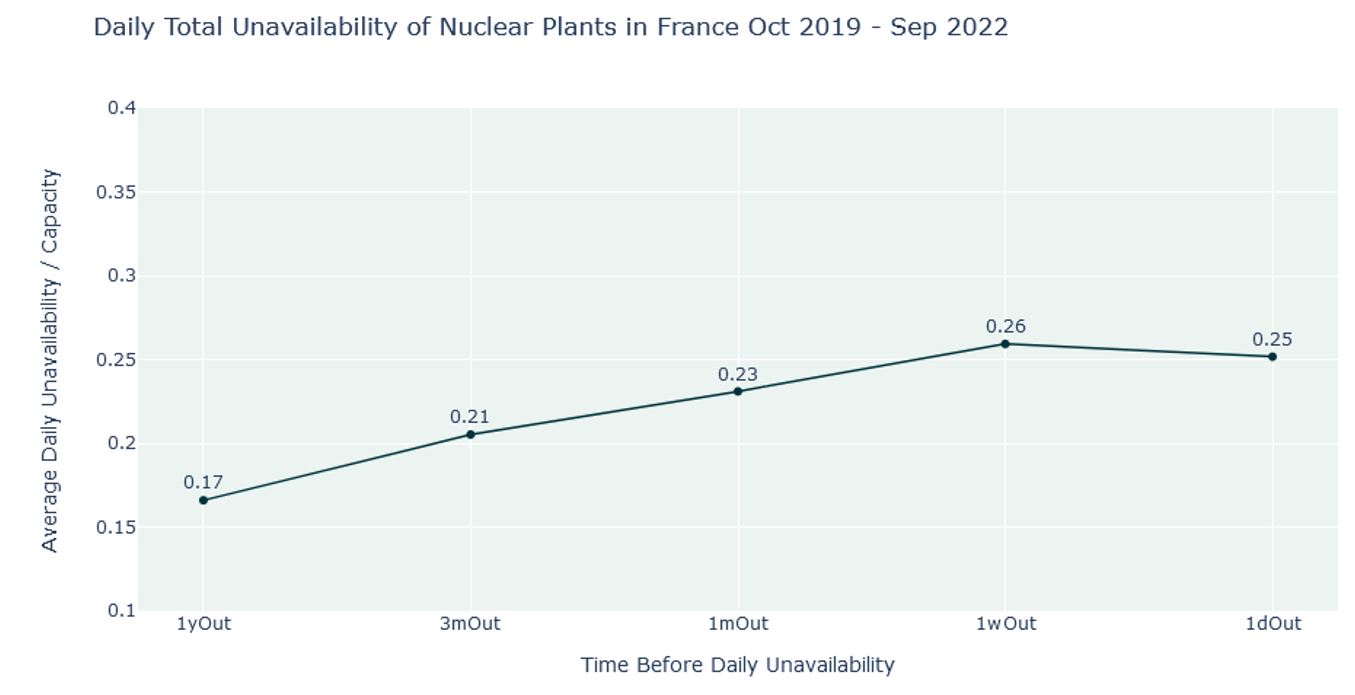

- Figure 4. Outages from October 2019 to September 2022

To understand how likely it is that the 30GW of French nuclear capacity returns in February, it is necessary to analyse past outage publications of French nuclear plants on ENTSEO. The graph in Figure 4. graph is a timeframe which is in daily granularity, showing the expected unavailability of the French Nuclear fleet reported on Entseo at varying timeframes before each day. The lines on this graph show the total outages published a year before each day in black up to a day before each day in green. Even though there are differences between the plots at all stages, it is noticeable that the volume of outages published or extended less than a month in advance increases drastically in April 2021 and beyond.

Unavailability

There is no obvious and distinct reason why this event happened in April 2021 however, France has experienced significant heatwaves and droughts over the last two summers, resulting in warmer rivers which hinders nuclear plants’ ability to discharge excess heat into waterways. In addition to environmental constraints, a number of planned outages for maintenance works were deferred by Covid lockdowns in 2020 and many were pushed to 2021.

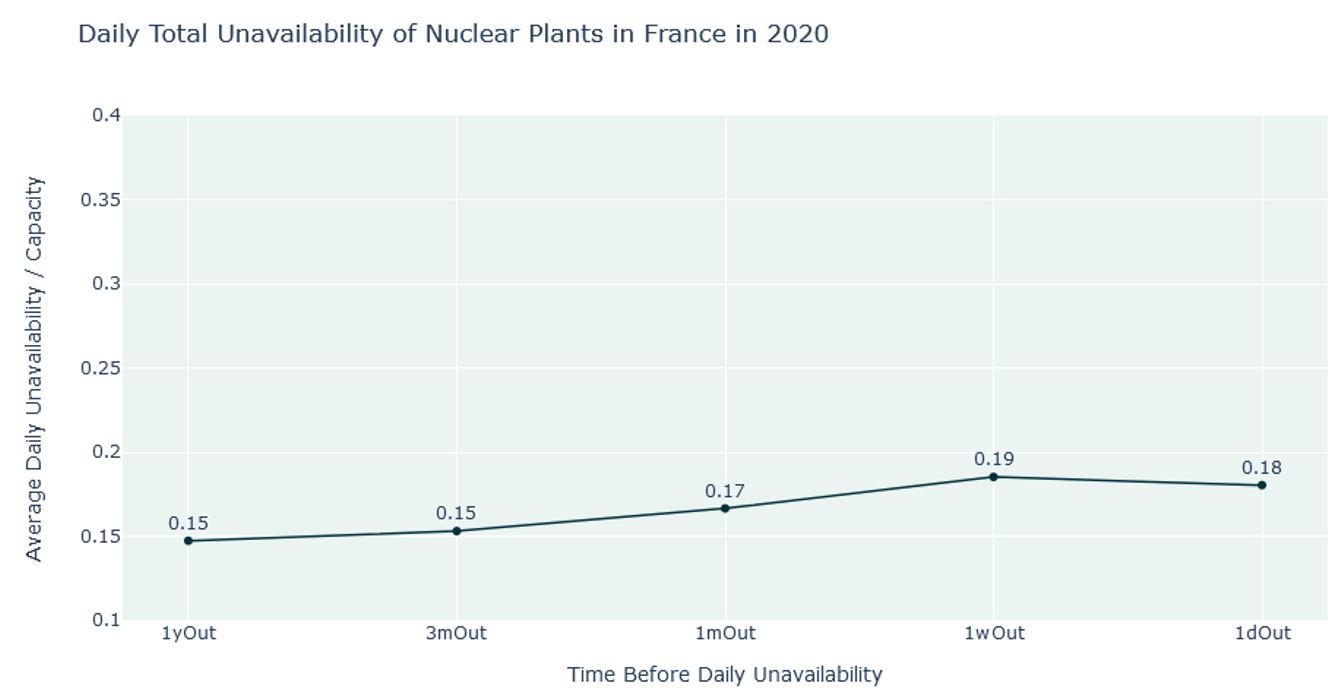

- Figure 5.

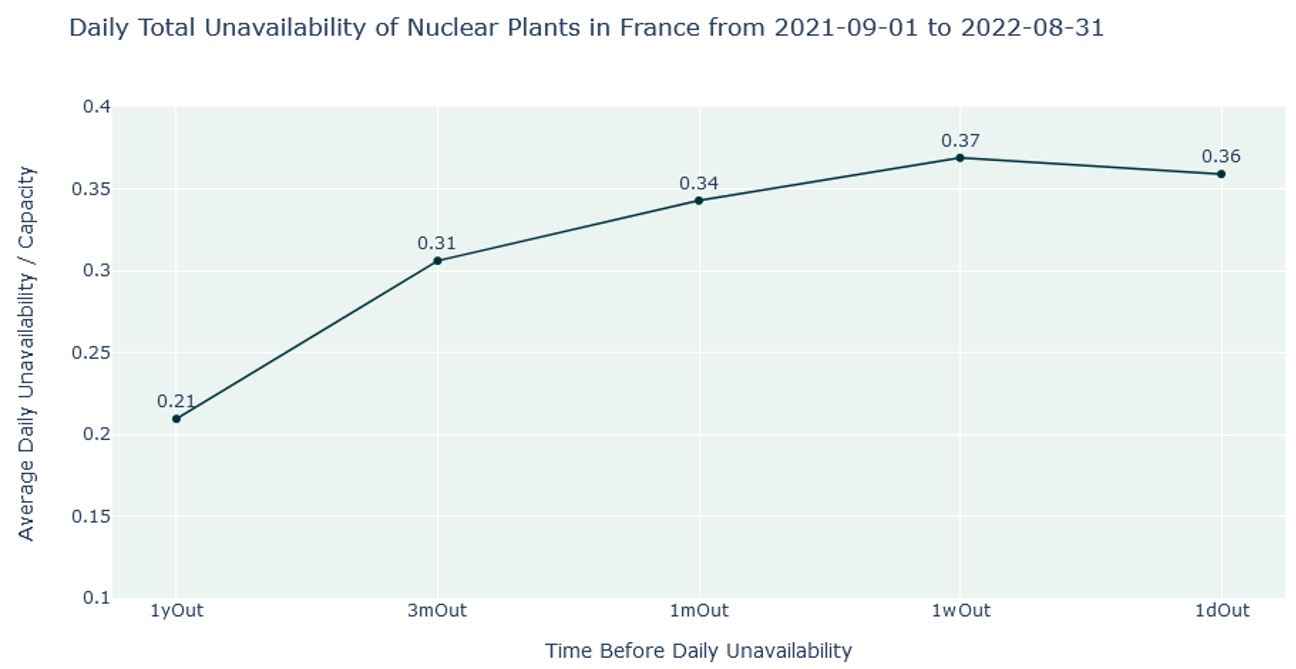

Figure 5. shows that there is an 8% increase in published unavailability of French nuclear power plants from a year to a day before any day on average. Figure 6. covers 2020 and it can be seen that there is lowered amount of increase (only 3%) in published unavailability levels from a year to a day before each day on average. Figure 7. displays September 2021 to the end of August 2022. This shows that there has been a 15% increase in published unavailability levels from a year to a day before each day on average. This 15% increase corresponds to a 9.4GW increase in unavailability. Again, to put this in context, that is almost double the average electricity consumption for the entire Island of Ireland.

- Figure 6.

- Figure 7.

Conclusion

With almost half of France’s 56 reactors shut down due to corrosion problems and maintenance and an unreliable outage publication, prior to the Christmas break, it appeared that the full 30GW of capacity that was planned to come back online by February would not be back.

The effects of such a steep power supply drop-off were partly offset this Winter period by an unusually higher-than-average temperature across Europe, reducing demand, with power demand in France for the start of 2023 at 54.1GW down from 69.4GW for the equivalent time period in 2022.

Slowly but surely reactors have been able to come back online, and demand has reduced further lowering power prices. However, the underlying issues remain with the reporting measures and availability of timely and accurate data.

Article written by Tara Desai.

If you would like to speak to ElectroRoute about our services, please email us at info@electroroute.com

Sources:

https://www.sciencedirect.com/science/article/pii/S0140988319303883

https://www.rte-france.com/en/eco2mix/power-generation-energy-source