Guest Blog: The Potential for Energy Storage in Ireland

The State of Play for Energy Storage in Ireland

Energy storage is a critical enabler of our renewable energy transition, and its importance is starting to be recognised by stakeholders across the energy sector.

To date, the storage market in Ireland has been focused on short-duration lithium-ion batteries, that can provide the fast-acting backup needed to support the power system with growing levels of renewables. There are currently 670 MW of primarily short-duration batteries in operation on the island of Ireland. These batteries contain frequency events by injecting power into the grid in milli-second timeframes. This has enabled EirGrid and SONI to reduce their reliance on fossil fuel spinning reserves allowing more space on the system for wind and solar generation.

The short-duration battery market is saturated at present so attention is turning to longer-duration batteries and other storage technologies that can provide additional benefits and capture other potential revenue streams such as energy arbitrage, peak shaving, capacity adequacy, congestion management etc. These longer-duration technologies will allow us to shift large amounts of renewable energy to help balance the system, reduce renewable dispatch down and provide an alternative to fossil fuels during times of low renewable output.

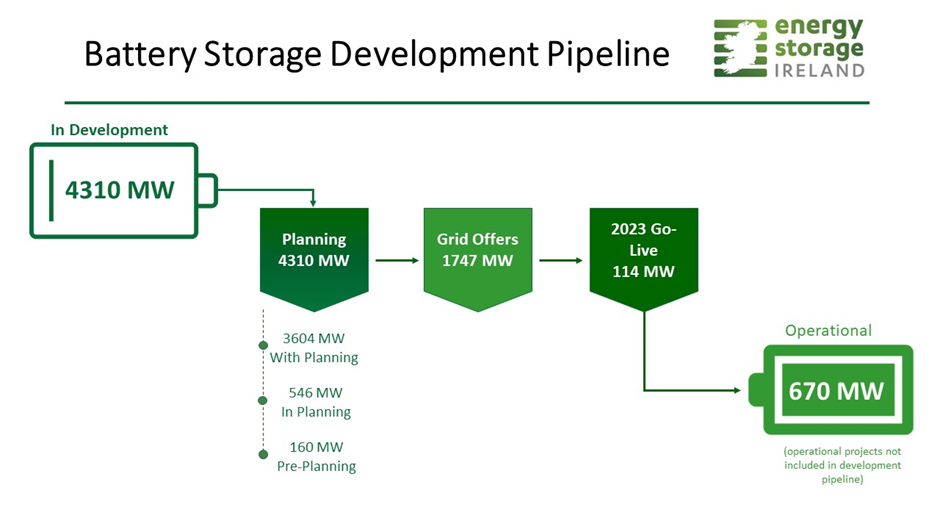

At ESI we carry out a pipeline survey of our members each year to understand how many energy storage projects are in development and what stage they are at. Our latest results as of the end of 2022 show there is a huge pipeline of just over 4,300 MW of battery projects in development with the majority already through the planning system and either in the grid connection process or awaiting the next grid connection round. These projects tend to be focused on durations of around 2 hours but the key benefit of storage is that it is flexible and can adapt to system needs and new business cases as markets develop.

How much energy storage will we need?

The battery storage deployed today is enough to meet Ireland’s short-term reserve requirements, but we are going to need a lot more energy storage from a variety of technologies with different capabilities by 2030. This will be essential to manage the large volumes of renewable generation necessary to meet our climate action targets.

In 2022, ESI carried out a piece of work with energy consultants Baringa to try and estimate how much energy storage might be needed by 2030 and what benefits it can bring to the power system and consumers. The output ‘Game Changer’ shows that energy storage can provide several major benefits besides providing zero-carbon reserve services.

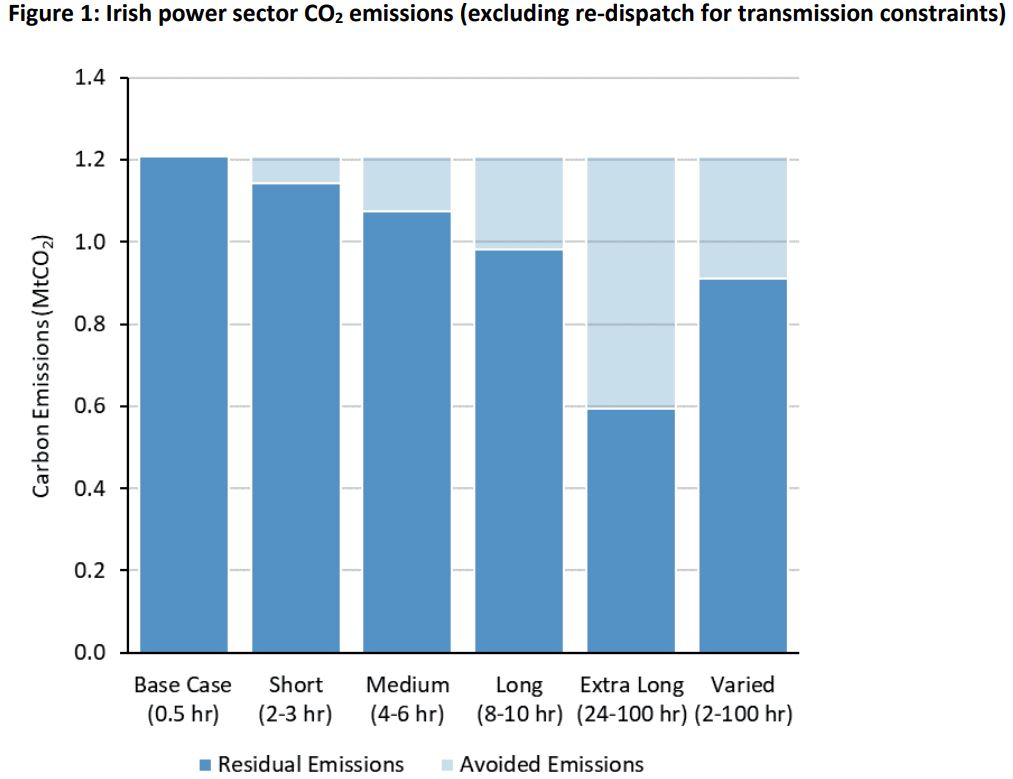

Baringa modelled a 2030 Irish power system with high levels of wind and solar and compared a base case with no additional storage buildout than what is already connected today against multiple scenarios with an additional 2 GW of storage of different durations from 2 hours out to 100 hours.

The results show that the longest-duration energy storage technologies can reduce power sector emissions by up to 50% in 2030. This is particularly important because at this stage these residual emissions are the hardest to abate so energy storage plays a critical role in soaking up renewable oversupply and displacing fossil fuels at times of low renewable generation.

The study also showed that medium-duration storage (i.e. 2-6 hours duration) can play an essential role in providing quick-to-deploy peaking capacity solutions to alleviate short-term periods of congestion and system stress. These can help mitigate against volatile wholesale prices, particularly during winter periods.

Longer durations of 24 hours plus are particularly important for solving generation constraints and for absorbing renewable energy that would otherwise be dispatched down. These storage technologies can reduce dispatch down due to renewable oversupply by approximately 55% in 2030.

Finally, Baringa estimated that each of the storage scenarios would deliver a net economic benefit for consumers when taking into account the locational value of energy storage. This ranged from €30 million up to €85 million per annum in the longer duration storage scenario.

Baringa’s assumption of an additional 2 GW of energy storage by 2030 should be seen as the minimum we will need. More will very likely be required, mainly as we aim towards net zero. Putting the right market frameworks in place will be essential to ensuring investment in the quantities and types of energy storage that will deliver the best value to the system and to consumers.

Challenges and Opportunities

Delivering the volumes of energy storage we will need for 2030 and beyond will require coordinated policy action and specific market incentives to drive investment.

There are several existing market policies and systems which were designed around conventional generation and need to be updated to accommodate energy storage. For instance, the TSOs’ market systems are undergoing needed upgrades so they can more effectively utilise operational storage assets in the energy market.

Grid policy also needs to be updated to allow storage projects to connect to the system quicker and make use of their full operational capability. We are seeing that storage can face restrictions in terms of its ability to export or import at certain times. This needs more appropriate policy from the Regulators and System Operators to recognise the value storage can bring to the system as a flexible asset.

Right now there is no long-term investment signal for energy storage. The energy market is focused on short-term price signals and optimising the dispatch of generation and the DS3 market is moving this way too with the coming introduction of short-term auctions. The capacity market is the only market where storage can access long-term contracts, but storage is disadvantaged here due to de-rating factors and price caps designed around the costs of new gas generators.

Storage shares many of the same characteristics as renewable generation in terms of being a high capex/low opex technology but does not currently enjoy the benefits of having long-term investment support that is available through the RESS scheme in Ireland and the anticipated CfD scheme in Northern Ireland.

Things may be about to change with the ongoing EU market design reforms and the expected publication of the first national policy for electricity storage in Ireland later this year. In addition, we expect further progress on Northern Ireland’s Energy Strategy including a new route to market for renewables and supporting technologies.

This could see the introduction of new market frameworks for energy storage that allow multiple storage technologies to compete for long-term price support. ESI has produced a position paper on how this procurement framework might work including how different technologies could be valued for their contribution to the system.[1]

Ireland can continue to be a world leader in renewable integration by putting in place investment signals for longer duration energy storage as we increase our wind and solar energy and strive towards our carbon reduction targets.

Guest Blog is written by Bobby Smith, Head of ESI,

Energy Storage Ireland (ESI) is an industry representative association comprised of members who are active in the development of energy storage in Ireland and Northern Ireland. Our aims are to promote the benefits of energy storage in meeting our future decarbonisation goals and to work with policymakers in facilitating the development of energy storage on the island of Ireland. We represent over 55 member companies from across the energy storage supply chain. You can find out more about ESI by visiting www.energystorageireland.com or by contacting info@energystorageireland.com

[1] https://www.energystorageireland.com/wp-content/uploads/2022/11/ESI-Position-Paper-on-a-Procurement-Framework-for-Long-Duration-Energy-Storage.pdf