Navigating Uncertainty: Understanding and Managing Risks in Today’s Energy Markets

Energy markets are experiencing increased levels of risk at present, even in the context of the unprecedented situation the markets were thrust into last year. Various geopolitical, environmental, and supply-related factors have converged to create an environment characterized by market volatility. Understanding these risks is crucial for energy market participants to effectively navigate the challenges that have been raised.

Recent Gas Market Volatility

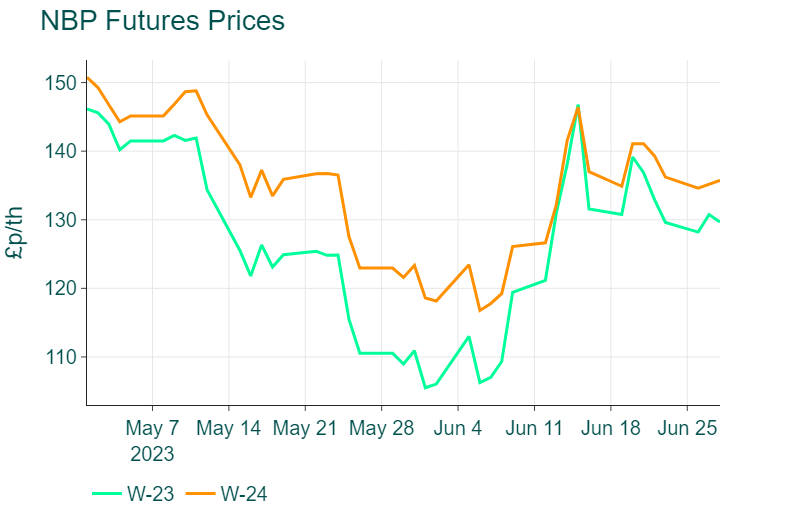

The volatility of the market was demonstrated by the spike in natural gas prices in June, rising by more than 50% after a period of decline. This price surge serves as a troubling reminder of last year’s energy crisis and highlights the vulnerabilities in the region’s energy market. The spike in NBP Futures prices for Winter 2023 and 2024 is shown in the graph below.

At TTF, the main European gas trading exchange, front-month futures prices surged by 78% at the beginning of June, peaking at 41 €/MWh. Analysts attribute this reversal to longer-than-expected maintenance outages at crucial gas plants in Norway.

While European natural gas prices are still lower compared to last summer’s levels, the rapid increase in prices this month underscores the region’s vulnerability to supply disruptions following a decline in imports from Russia.

Gassco, Norway’s gas network operator, announced on its website that a planned shutdown at one of its gas processing plants has been extended until July 15, originally scheduled to come back online on June 21. Additionally, two other gas plants will remain offline indefinitely due to process problems. Norway replaced Russia as the largest source of natural gas imports in the European Union last year, supplying over 24% of the market.

Furthermore, reports of the Netherlands planning to permanently shut down its Groningen gas field in October, earlier than previously considered, have further fuelled the price spike. This field, once a major gas supplier for Europe, has been gradually reducing production over the past decade due to earthquake risks. Although the field now accounts for only a fraction of Europe’s gas supply, the possibility of its closure in October has unsettled traders, resulting in gas futures reaching an intra-day high of nearly 50 €/MWh.

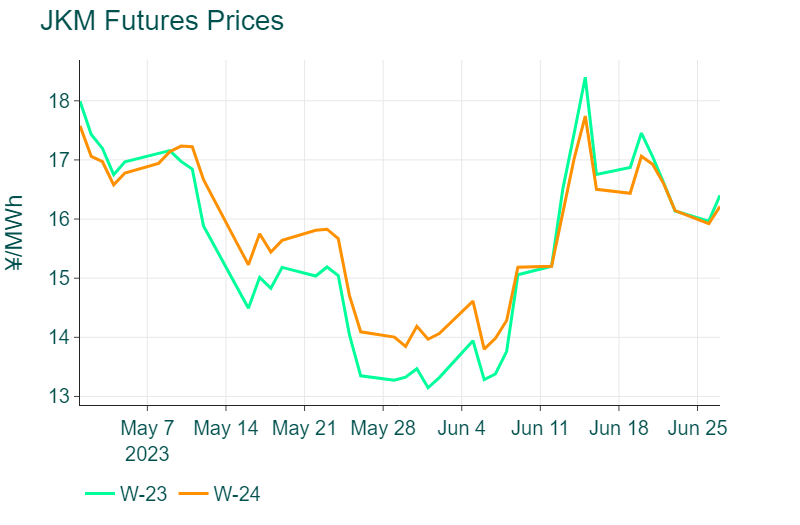

Similar price increases were noted in Asian markets, even with record levels of storage in Japan and Korea. This is important for European markets given the new role that LNG plays in the system. Spiking prices in Asian markets can mean that floating LNG ships divert to Asia, leading to lower injections in the European market and a potential for prices to rise further.

The gas price spike in June underscores the continuing precarious nature of Europe’s energy market. It serves as a stark reminder that while efforts have been made to diversify gas sources and reduce dependence on specific regions, vulnerabilities still exist, and supply disruptions and geopolitical incidents can have a profound impact on gas prices.

Lingering Irish System Security of Supply Issues

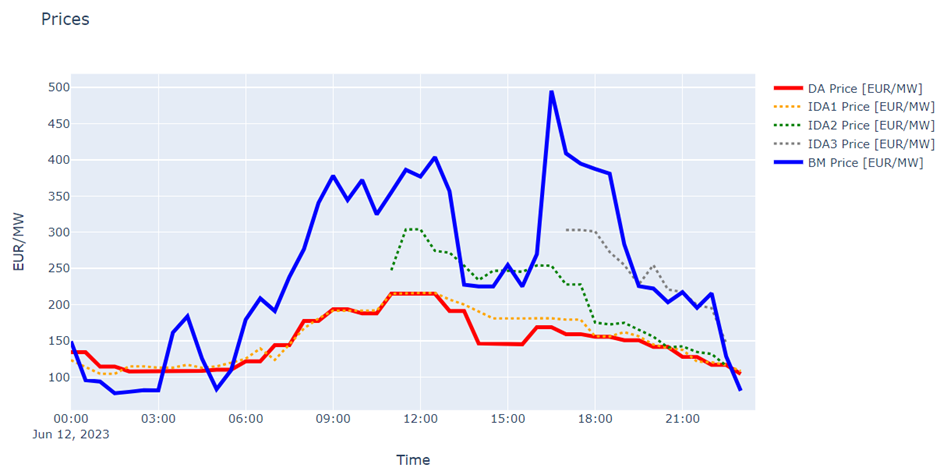

There are still concerns around the security of supply in Ireland, highlighted by the Amber Alert that was issued midday on 12th June. The event occurred due to low wind generation, a large increase in power demand relative to previous weeks and a couple of large plant outages. At the day-ahead stage on 11th June, a minimum of around 1GW of net margin was forecasted, but the drop in system-wide wind generation and an additional unplanned outage caused additional shortness within the system resulting in the alert. Although it was lifted by 18:34 on the same day, the IDA3 price during the evening peak was twice as high as the DA price, at approximately 300 €/MWh, and the imbalance price reached almost 500 €/MWh, shown in the chart below.

New planned interconnectors to GB (Greenlink, expected Q4 2024) and France (Celtic, expected Q4 2026) and increased storage and fast response generation (including 700MW of planned TEG) will in time hopefully help to ease security of supply concerns in Ireland, but in the short-term, the outlook still looks uncertain.

European Geopolitics Driving Further Uncertainty

Recent events such as the decline in French nuclear availability, higher than normal European capacity storage, and the ongoing situation in Ukraine have highlighted the impact that geopolitical risks have on large demand users’ energy costs. These risks have created a complex and volatile environment, where energy prices are susceptible to sudden fluctuations and uncertainties.

Due to a milder-than-expected winter, storage levels reached record highs by the end of Europe’s heating season. This surplus of stored gas has led to a smaller-than-average volume required for refill this year. Consequently, futures prices have moved into contango, reflecting the need to cover storage costs. The combination of ample storage capacity and lower refill demand has contributed to the overall dynamics of the European gas market, adding another layer of complexity to energy pricing and market behaviour.

In 2022, France transitioned from being a net exporter of electricity to a net importer of electricity and so far in 2023, the country’s nuclear power output is 17.5% below the 2020/21 average. This decline can be attributed to various factors. First, most of France’s nuclear power plants were constructed around the same time, in response to the energy crisis that occurred in 1973. As a result, during the winter of 2022-2023, twenty-six out of fifty-six power plants underwent mandatory maintenance or repairs simultaneously. Since these plants were largely built to a single standard, any issues discovered in one plant necessitate repairs in others. Widespread industrial action in France, the result of government policy changes, including raising the retirement age by two years, has been causing delays to this mandatory maintenance on the EDF’s nuclear fleet.

A political decision made in 2012 by François Hollande to earn votes from the Green Party resulted in the shutdown of two reactors in Fessenheim and a commitment to reduce the proportion of nuclear energy generated by 50% by 2025. However, France is unlikely to follow through on this commitment, with the proportion of energy generated from nuclear currently at 70%.

The Ukraine war inevitably continues to dominate the geopolitical outlook in Europe, highlighted further this month by the announcement from Kyiv that Russian gas flows through the country was likely to be shut off at the end of 2024 when the current deal with Gazprom expires – understandably, the chances for renewing the five-year transit contract are slim.

How To Navigate Uncertain Times?

While we haven’t quite seen the level of market price fluctuation that Summer 2022 brought, this recent market price shock combined with the general geopolitical and energy system situation demonstrates that we are by no means out of the woods. Add in a lack of hedging options in Ireland with the suspension of Round 20 of Directed Contracts, high capital constraints on exchanges, persistently high inflation levels, and rising interest rates and it becomes very difficult for business to plan for this winter or beyond with any sort of certainty.

Consequently, ElectroRoute has developed a suite of energy risk-managed products to help businesses and large energy users navigate through these volatile times.

For further information please contact David McInerney (david.mcinerney@electroroute.com)