Route to Market Options for RESS 1

Route to Market Options for RESS 1

1. Introduction

It is an exciting time in the Irish renewable space at the moment with the first Renewable Energy Support Scheme[1] (RESS) auctions due to commence soon with a closing date for submissions of 28 July 2020.

We have been working with various wind and solar developers as they develop trading and balancing solutions for their RESS assets and one common question we are asked is “What Route to Market Structure is best for me?”. The purpose of this Insight is to help answer this question.

Under RESS, in a manner similar to REFIT, the RESS generator is required to enter into a Power Purchase Agreement (PPA) with a licenced supply entity (Supplier). The subsidy payment is made via the Public Service Obligation Levy (PSO) to the Supplier.

The two most common routes to market for Irish renewables over the last five years has been:

- Traditional Power Purchase Agreement

- Supplier Lite Structure

In this article we describe both structures and highlight the advantages and disadvantages of each.

2. Power Purchase Agreement

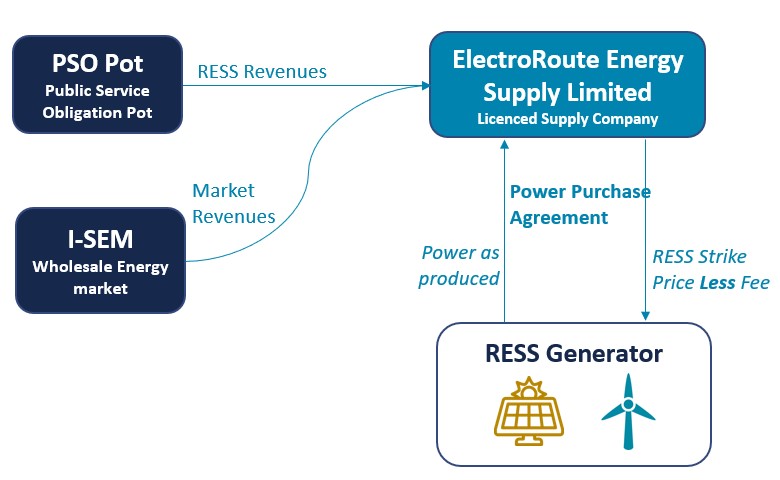

A traditional PPA is a standard agreement whereby the RESS Generator contracts with a licenced supplier (such as ElectroRoute Energy Supply Limited) under which the Supplier purchases every MWh of power produced by the Generator and in return pays the Generator a pre agreed price as shown in Figure 1. For RESS 1, this price is likely to be the Generator’s Strike Price less an agreed Fee.

Figure 1 – Typical Power Purchase Agreement Structure

The PPA is the most straightforward, and least administratively intensive route to market for a Generator – typically the supplier will manage all market interfaces, trading, balancing, collateral, working capital and PSO cashflows and in return earns the Fee.

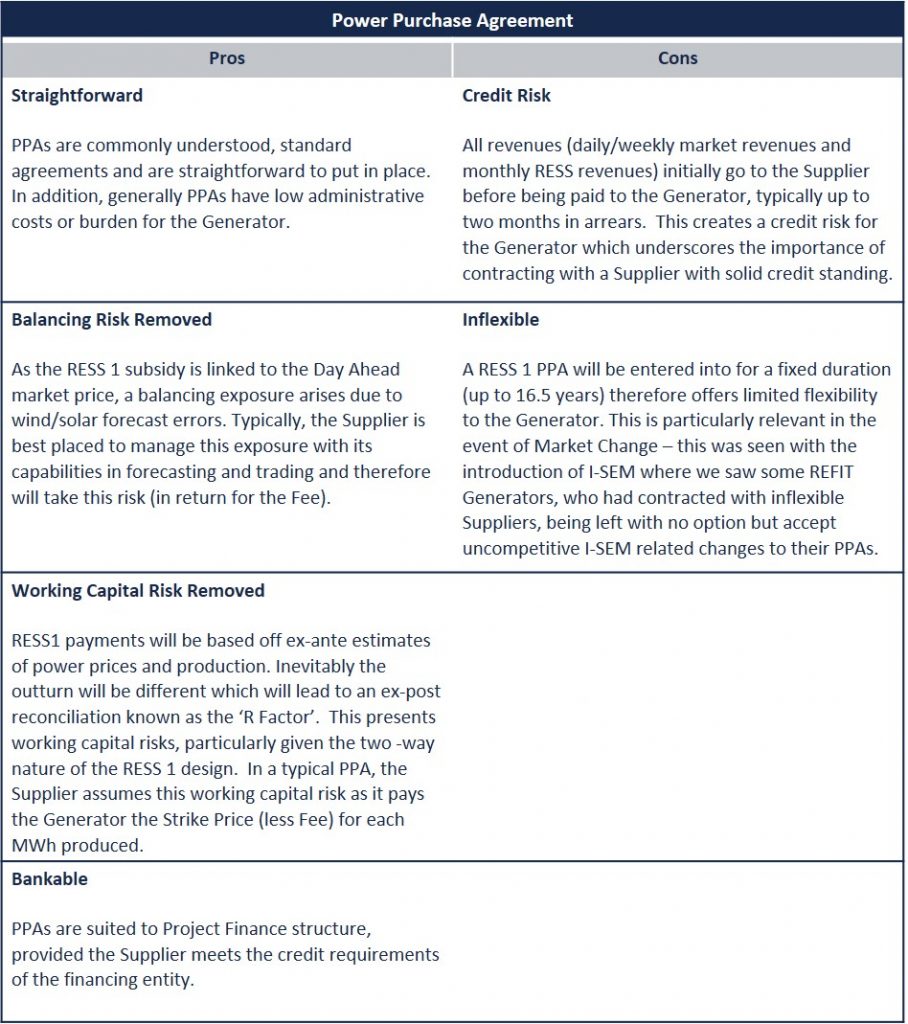

They key advantages and disadvantages of a Power Purchase Agreement are as follows:

3. Supplier Lite Structure

ElectroRoute estimates that approximately 40% of REFIT 2 onshore windfarm generators (over 900MW) adopted a Supplier Lite route to market. The structure became popular from 2015 onwards for a few reasons, predominantly:

- At that time the only entities offering long term PPAs were the incumbent utilities who were not providing competitive or flexible offerings,

- Generators were aware that the introduction of I-SEM would result in market change and did not want to enter into inflexible long term contracts with the utilities, and

- the emergence of ElectroRoute who pioneered the provision of services to enable bankable Supplier Lite structures.

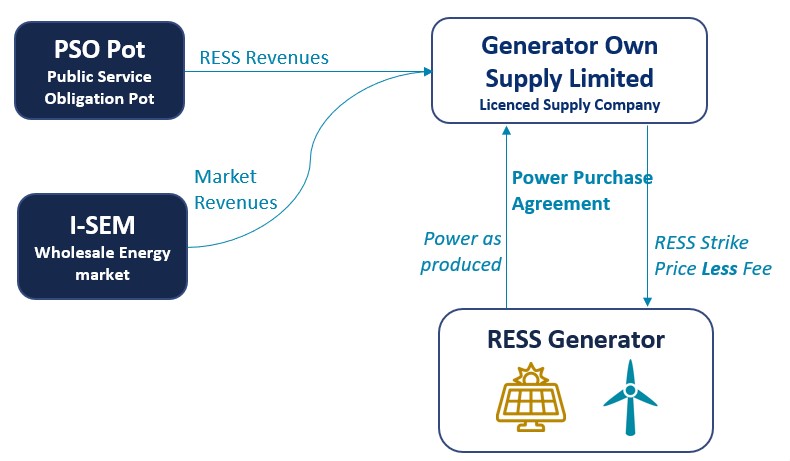

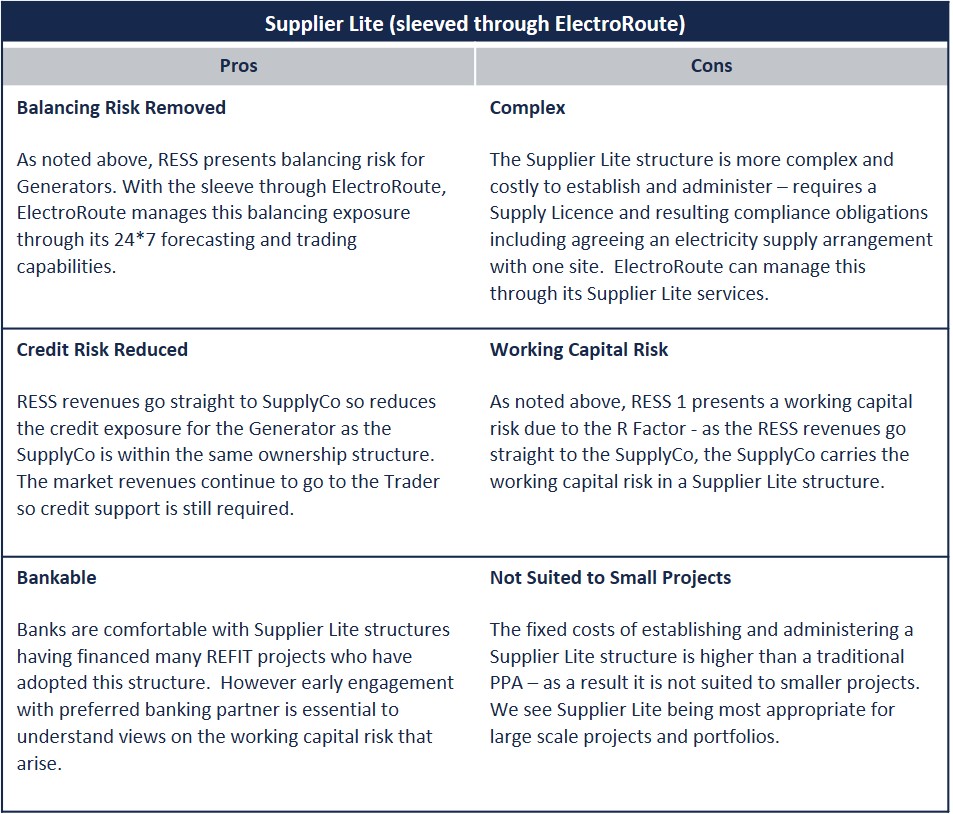

The Supplier Lite structure is very similar to the PPA structure, with one key difference. Instead of entering into a PPA with a third party offtaker (such as ElectroRoute or a Utility), the Generator sets up its own licenced supply vehicle with which it contracts. See Figure 2 for an illustration of this.

Figure 2- Typical Standalone Supplier Lite Structure

Having its own supply vehicle (SupplyCo) allows the Generator to control its PPA and Route to Market, however, in most scenarios, a Generator will not have:

- the ability to manage the compliance requirements of owning a licenced supply entity

- the market access and trading capability to (eg SEMOpx access, clearing bank structures etc)

- 24*7 trading and forecasting capability to manage balancing risks.

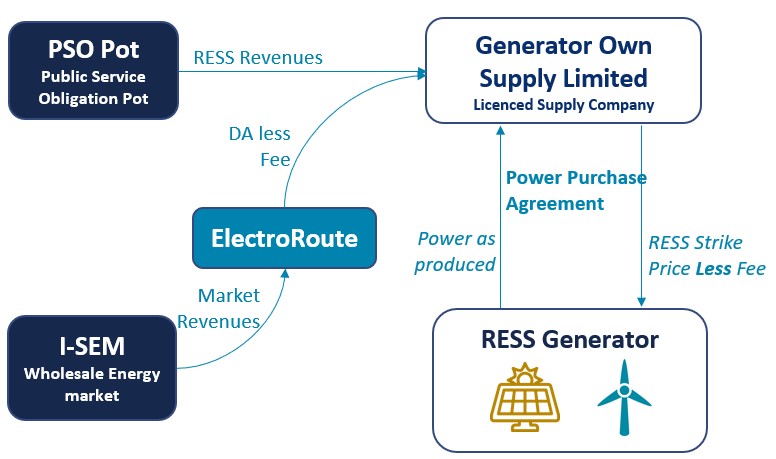

Therefore usually the SupplyCo will contract with a third party trader, such as ElectroRoute, who assumes responsibility for market interfaces, forecasting, trading and balancing and pays the Day Ahead reference price to SupplyCo less a pre agreed Fee for each MWh.

PSO management and R Factor related working capital remains the responsibility of the Asset Owner. Figure 3 provides an overview of how such a structure works.

Figure 3- Supplier Lite (sleeved through ElectroRoute)

4. ElectroRoute RESS Services

Whether an Asset Owner decides to follow the PPA or Supplier Lite structure, ElectroRoute can provide competitive, bankable solutions underpinned by credit support.

Through its solutions, ElectroRoute will, for a fixed fee per MWh,

- Take all balancing risk exposure

- Provide access to the ex-ante I-SEM markets (SEMOpx & clearing bank access)

- Manage all trading and market interface requirements

- Take responsibility for all wind/solar and price forecasting costs

- Cover all trading fees and all collateral movements with the market.

If you wish to discuss route to market options for your future RESS project, please reach out to our team at clientservices@electroroute.com.

ElectroRoute’s 24*7 trading desk

Reference

[1] https://www.dccae.gov.ie/en-ie/energy/topics/Renewable-Energy/electricity/renewable-electricity-supports/ress/Pages/default.aspx