Life after Brexit

Life after Brexit

As the first month of the post Brexit trading arrangements has come to an end, it is time to look back and see how I-SEM has been affected.

What happened?

On January 1st at the end of the Brexit Transition period the GB market decoupled from the European Internal Energy Market (IEM). The lead up to this has been covered in a previous blog here. (https://electroroute.com/interconnecting-the-dots-on-future-brexit-arrangements/).

The channel interconnectors IFA (2,000 MW), IFA2 (1,000 MW), BritNed (1,000 MW) and NemoLink (1,000 MW) now have their capacity allocated via explicit daily auctions rather than the implicit auctions that are used as part of the Euphemia Price coupling mechanism. As Ireland was connected to Europe through our interconnection with GB we also decoupled from the IEM. Ireland and GB moved to local day ahead power auctions with the full capacity of Moyle (500 MW) and EWIC (500 MW) available to be allocated implicitly in the SEM-GB coupled auctions IDA1 and IDA2.

How did the GB and I-SEM Markets react to all this change?

January has been overshadowed by periods of low generating margins in GB and Ireland and the high prices that followed these. The imbalance price in GB reached £4,000/MWh on Friday 8th of January. The I-SEM imbalance price reached a high of €1,720/MWh for two periods on Tuesday 12th of January.

Were these high prices a result of the change to the markets? Or would they have happened anyway?

January saw high demand in GB due to colder temperatures, unavailability of some gas and nuclear plants and low renewable output due to the calm weather. This, along with the reduction in coal generation over the last number of years in the UK led to very tight generation margins and market notices, such as the below, being published.

If generation margins on the Irish system are tight during these times and if the interconnectors are due to export over the evening peak, then EirGrid may be required to reduce or even reverse the flows of the interconnectors. This will come at high cost through a series of SO-SO trades with National Grid. So, the high imbalance prices are not necessarily a result of the new trading arrangements. The auction prices are a different story…

While the new arrangements do not guarantee higher auction prices, they have led to a greater price divergence between the UK day ahead market and the Continental markets.

BritNed has been on an outage and is not due back until early February. IFA2 (1,000 MW) was only commissioned on 24th of January. So that left only Nemo Link and IFA flowing power into GB for most of the month. With low generating margins forecast over hours of peak demand, this was only going to send GB day ahead prices one way, upwards! As Ireland experiences similar weather conditions to GB and had a number of significant outages over the month I-SEM Day ahead prices also followed suit. But what about the intraday auctions… In December we posed some questions on how the I-SEM market, particularly the intraday auctions, would be affected. These are addressed below.

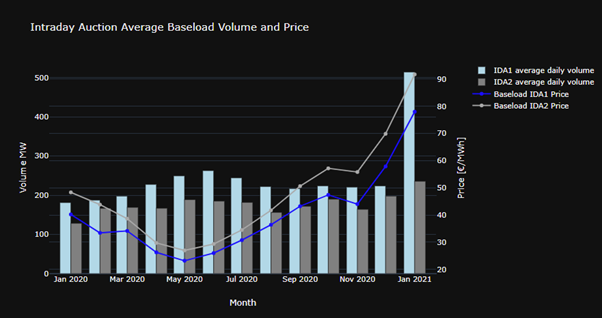

Have intraday traded volumes increased?

The below chart shows the IDA1 and IDA2 average traded volume per month since January 2020 as well as the average baseload auction price for each month. There is a clear step change in volumes traded in IDA1 since the start of January. IDA2 has not seen as significant an increase in volumes. This is likely because the buying demand was coming from GB and all the room on the interconnectors was taken up in IDA1. The increase in the baseload prices is due to an increase in gas prices and GB buyers willing to pay a premium to the I-SEM Day ahead price.

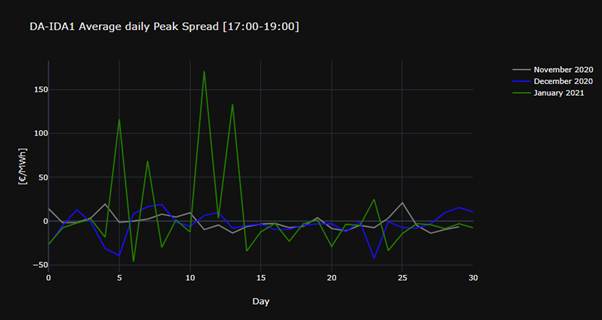

Has the volatility between I-SEM DA and IDA1 increased?

The below chart shows the spread between DA and IDA1 prices for the hours of peak demand (17:00-19:00) for each day of November, December, and January. Greater than zero means that the IDA1 price cleared higher than the DA price.

The volatility has increased significantly on tight margin days due to the magnitude of the GB day ahead price and GB balancing prices. On days where generating margins are not an issue the volatility is not as high. More data will be required to see whether this relationship holds over the long term.

Will there be enough GB participants willing to trade in IDA1 and IDA2?

So far it seems as though there are enough GB participants willing to trade in IDA1 as GB traders look to take advantage of lower prices compared to the GB day ahead price. The issue may be that there could be too many I-SEM sellers in IDA1 and IDA2 under certain conditions.

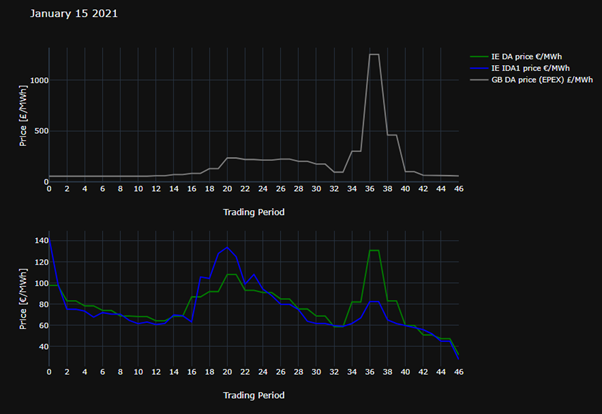

Taking January 15th for example, wind was forecast to ramp up in Ireland across the day, while the wind in GB was forecast to remain low. The GB Day Ahead price cleared at an eye watering £1253/MWh for the peak hour, while the I-SEM Day Ahead price cleared at €130.97/MWh on the peak. I-SEM traders looked to IDA1 as an opportunity to sell at a better price. As the chart below shows, this worked out for the day off peak hours, but it backfired over the evening peak with IDA1 prices dropping relative to DA as too many sellers tried to clear their volume.

Conclusion

Tight winter margins are here to stay particularly during periods of cold weather, plant outages, and low renewable generation. The unavailability of the interconnectors in the day ahead auctions in GB and I-SEM will continue to affect Day Ahead prices particularly on low margin days. This will also increase the volatility between Day Ahead and IDA1 prices. However, if too many participants try to take advantage of this it will likely work against them as there is only so much room on the Irish Sea interconnectors.

If the GB and I-SEM markets had remained in the Internal Energy Market this would have provided downwards pressure on the GB Day Ahead prices in January and less volume being traded in IDA1 along with less volatility. The interconnectors going explicit has been good for dispatchable generators but will cause some pain for suppliers due to higher power prices. More data will be required to fully assess the impact of the post-Brexit trading arrangements over the long term.

For intermittent generators who also have to worry about forecast errors these price spreads on tight days can cause a headache. Some form of price coupling is due in April 2022 [1]. However, the timeline for getting this done seems ambitious.

Please contact our Client Services team if you would like to explore the trading services ElectroRoute can offer to allow you to mitigate the risks or maximise the opportunity of these new market conditions.

[1] https://ec.europa.eu/info/sites/info/files/draft_eu-uk_trade_and_cooperation_agreement.pdf