An Overview of Trading for Batteries in SEM

Trading for Batteries in SEM – an Overview

The development of the battery storage market on the island of Ireland, and indeed throughout Europe, is undergoing a somewhat expected surge in activity owing to the development of both the market structures and more generally the market characteristics, required in order to make a business case for the technology.

Following the recent announcement that ElectroRoute will be providing trading services to the 200MW portfolio of batteries with [Lumcloon], ElectroRoute outlines below the business case for battery storage projects on the island of Ireland at present, and points to the direction of travel for the business case over the years ahead.

DS3 – Lowering the barrier to entry for battery storage facilities

An important source of revenue for batteries in Ireland at present is the DS3 ancillary services regime, named DS3 due to its objective of “Delivering a Secure, Sustainable, Electricity System“.

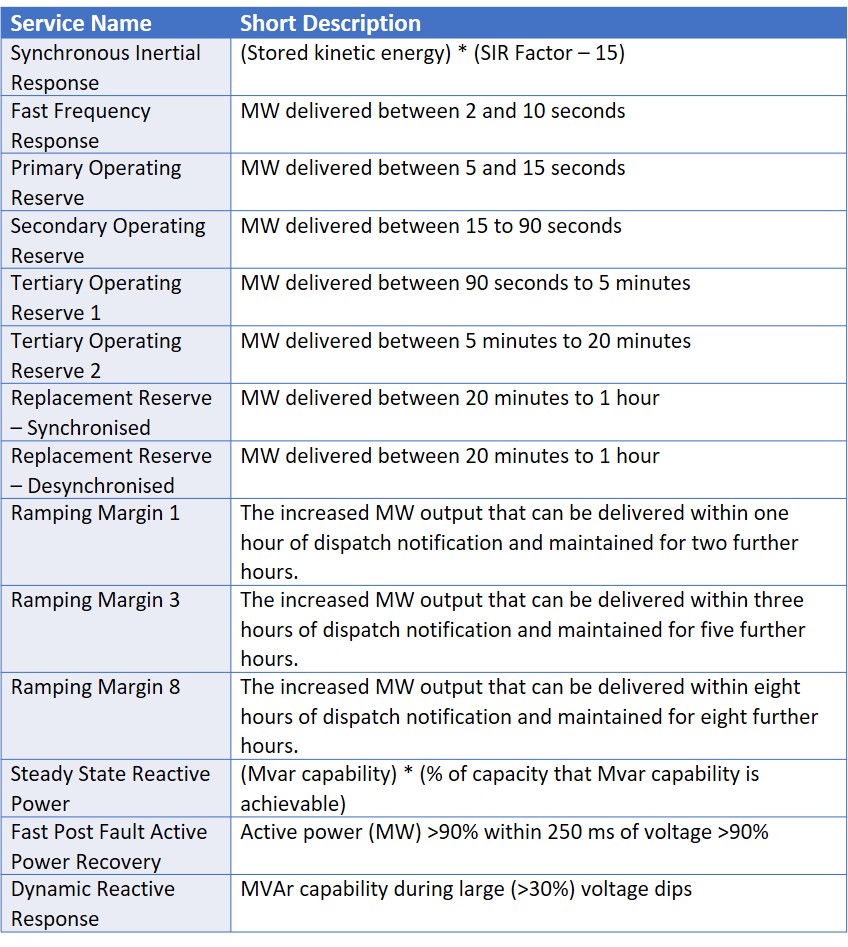

Established by EirGrid in response to the recognition that the power system would need to develop substantially to operate in a safe and secure manner whilst accommodating increasing penetrations of renewables over the coming decades, DS3 is a wide reaching programme which includes the operation of 12 system services (with 2 further services to be procured in later gates) that can be provided by units operating on the power system.

The table below outlines the full list of ancillary services procured by EirGrid;

Battery technology is an excellent source of capability for a number of these services, particularly the faster acting frequency and reserve products.

The DS3 regime has two routes to market, namely via the Volume Capped auctions and Regulated Arrangements Volume Uncapped (“Regulated Arrangements”) tenders. The Volume Capped auction has completed and contracts are awarded (110MW of Volume Capped contracts were awarded to three battery facilities in 2019) with no current expectation of a new auction. The Regulated Arrangements continue to operate on the basis of a semi-annual tendered service.

Regulated Arrangements

The Regulated Arrangements for DS3 services operate on the basis of a bi-annual gate through which contracted parties can be included as providing units, subject to having passed EirGrid led testing on the battery’s ability to adequately provide the service tendered for.

These arrangements are expected to continue in force until April 2023. At this time, the DS3 contracts allow for two separate 18 month extensions where deemed required. In a recent SEM Committee Scoping Paper on the development of future System Services arrangements, it was outlined that such extensions will be approved by the regulatory authorities where the future arrangements are not yet in place. The contracts will therefore be expected to end should the future arrangements be put in place.

Stacked Revenue Streams

There are three market-based revenues streams available to energy projects on the island of Ireland, namely;

- Capacity Remuneration Scheme

- Energy Market Revenues

- DS3 Revenues

Unlike the Volume Capped contracts, batteries with a DS3 Regulated Arrangement can also seek revenue opportunities in the energy and capacity markets. However, the DS3 contract is structured to commercially incentivise high availability, so it is important that the route to market is managed to optimise available revenues.

At present, the DS3 rates are reasonably significant for providing units, which has encouraged a focus on this market for developers. DS3 revenues are expected to reduce as more providing units coming to market will have the effect of cannibalising these revenues. We therefore expect increasing reliance on the dynamics and price signals of the energy market to become a key consideration for battery developers in the near/medium term.

Energy Arbitrage – the Heir Apparent

The DS3 budget is limited to €235million per annum and has been increasing on a linear scale since 2015 (€54million per annum budget). We therefore see that with a capped budget and a surge in projects looking to avail of DS3 rates, the only lever which can be moved is the rate of payment.

The regulated tariffs can be altered in limited circumstances prior to the end of term including for circumstances where the budget cap is expected to be breached or where more services are procured than required. As a result, either at the end of contract term or potentially before, it is generally expected that the increased uptake in DS3 contracts will result in a cannibalisation of the tariffs available to projects in future years.

The DS3 rates will therefore over time become more comparable to those attainable for battery technology in energy /arbitrage markets. We see that ensuring an appropriate trading strategy which considers the risk profile of the project sponsor will become an integral part of the business model going forward.

Equally, the design of the battery, and the appropriate selection of import and export capacities for the sites will become a deciding factor in which batteries are capable of transitioning to an arbitrage led busines model.

In the next of our series on battery storage Insights, we explore the limitations and challenges of existing battery developments to adapt to a market less reliant of system services and more focused on capturing optionality in the energy market.

If you would like to speak to ElectroRoute regarding our Trading Solutions for energy storage projects in Ireland, please contact brian.kennedy@electroroute.com