Energy Security for Ireland: This Winter and Beyond

Energy Security for Ireland: This Winter and Beyond

In 2022, we have witnessed unprecedented challenges in the energy market. The current state of energy security in Ireland is heavily reliant on imports and an ageing gas fuelled power sector. Ireland has now developed a plan for both the near-term and long-term outlook which looks at our Oil Security, Natural Gas Security and Energy Security particularly due to the tightening of global gas markets exacerbated by the Russian invasion of Ukraine.

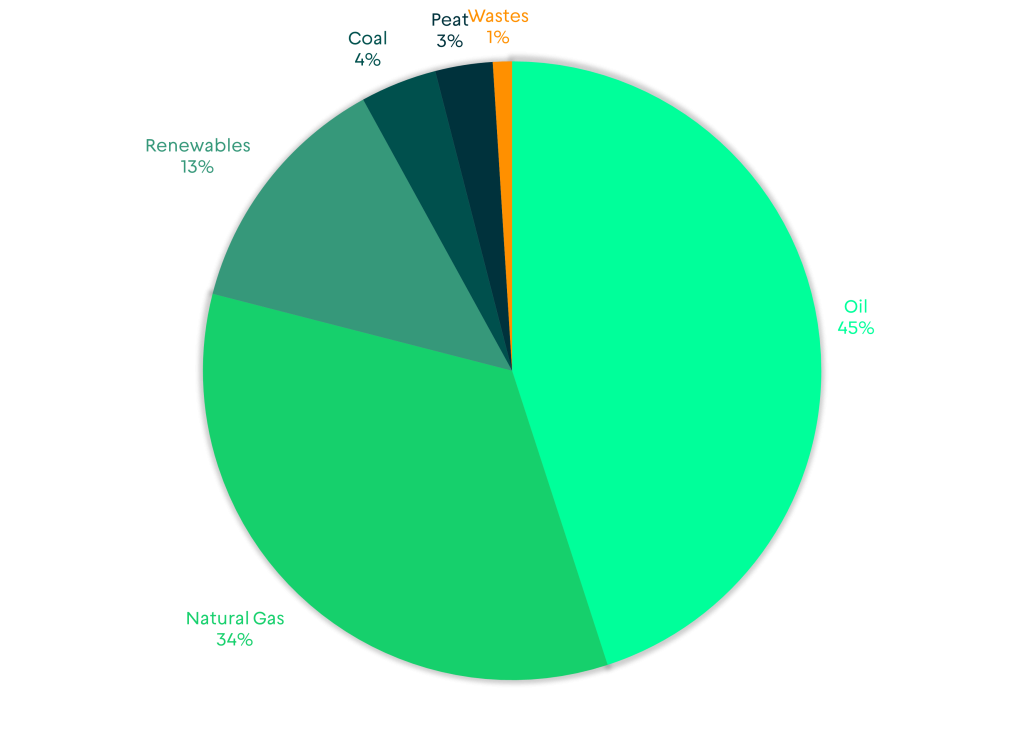

Figure 1. Ireland’s Primary Energy Requirements (SEAI 2020) Ireland’s Energy System

– a quick overview

Ireland imports over 70% of its total energy requirements, in the form of heating, transport and power generation. This is higher than the EU, which imports nearly 60% of its total energy use needs.

Oil and natural gas represent about 80% of Ireland’s primary energy requirements.

The Governments Climate Action Plan 2021 sets out to increase the share of electricity consumption coming from renewables to 80%, as well as enhanced energy efficiency within the transport and residential sectors. In 2020, renewables accounted for 42.5% of the gross final electricity consumption.

1. Oil Security

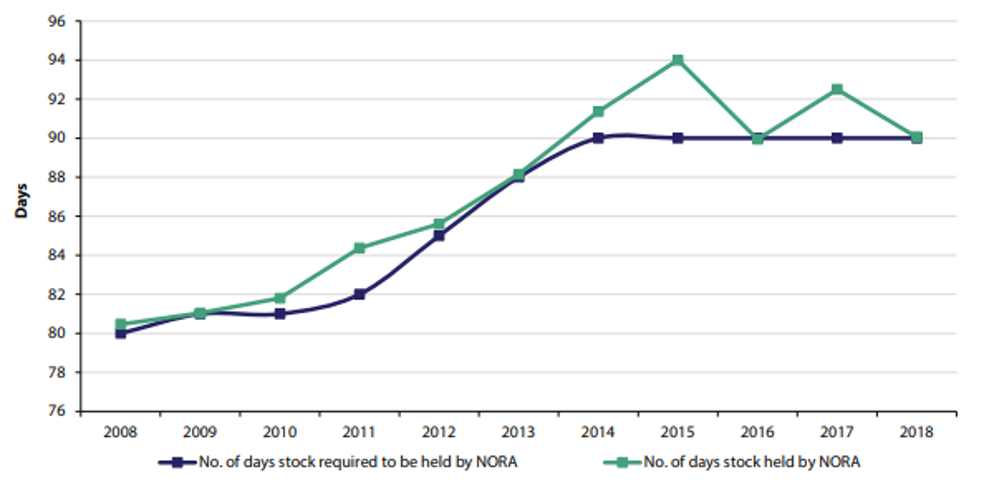

The National Oil Reserve Agency (NORA) maintains 90 days of strategic oil reserves, stored in oil storage facilities in Ireland, the UK and EU member states with whom Ireland has a Bi-lateral Oil Stockholding Agreement.

Currently, NORA holds c.72% of its total oil stocks in Ireland and the remaining balance abroad. This reserve is spread across various products, including petrol, diesel, gas oil, kerosene and jet fuel.

Stocks are currently held in oil storage facilities in Dublin, Cork (Whitegate Refinery), Whiddy Island, Foynes, Shannon, Tarbert, Galway, Derry and Kilroot. European stocks are held in Denmark, Sweden and Spain.

- Figure 2. NORA Stock Holding Requirements (SEAI)

In Figure 2 it can be seen that the number of days of oil stocks kept by NORA has been greater than the required number of days to be held.

As Ireland has no domestic oil production all reserves need to be imported:

- One-third of the imported oil is crude oil which is refined into oil products at the Whitegate refinery.

- The remaining two-thirds are imported as refined products.

Irish crude oil imports are sourced from Norway, Denmark, the US, the UK and OPEC member countries. Refined products are sourced from the UK, the US, Sweden, the Netherlands, Norway, Belgium and previously Russia.

The commercial oil sector in Ireland operates on a just-in-time basis, with relatively limited supplies held by suppliers at any one time.

2. Natural Gas Security

Irish natural gas supply depends on imports from a single source, the Moffat interconnection point between Ireland and Scotland. The Corrib Gas Field, Ireland’s only indigenous source of natural gas, is set to decline over the next 10 years. This coming winter (2022/23) Corrib is anticipated to meet 21% of ROI natural gas demand, and 16% of the island’s total demand, Moffat will supply the rest. In winter 2021/22 Corrib met 28% of the Republic of Ireland’s natural gas demand.

High dependence on imports from the UK, along with the reliance of the electricity system on natural gas supplies, means that Irelands needs to urgently diversify its gas supply options and explore the development of Liquified Natural Gas (LNG) facilities on the island. While there are lingering concerns regarding LNG, it does present Ireland with the least-worst option to manage security of supply during the period of the transition to 100% renewables.

3. Electricity Security

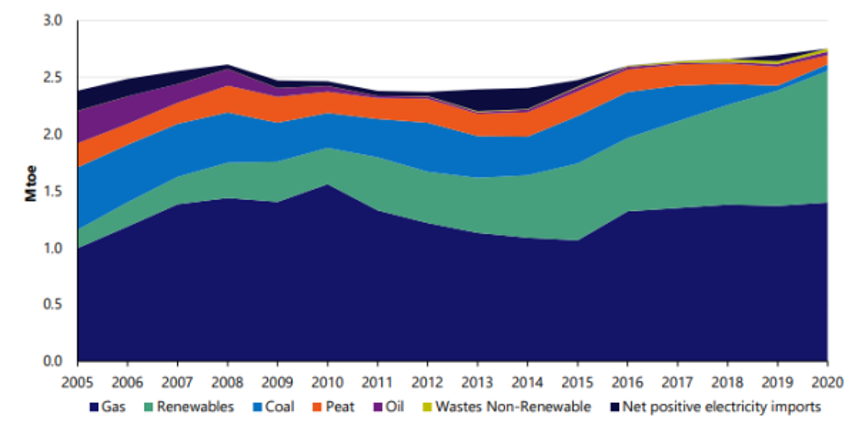

- Figure 3. Electricity Generated by Fuel Type (SEAI)

Natural gas is used to generate around 50% of Ireland’s electricity, therefore, any impacts on the natural gas supply will affect the electricity Security of Supply. The other 50% is generated by a mix of renewables, coal, oil and waste-to-energy, with renewables increasingly becoming a larger proportion of the mix in recent years.

All large gas-fired power stations are required to have secondary fuel capacity along with oil stocks that would allow them to operate for 3-5 days without natural gas, in case of an interruption to natural gas supplies.

Moneypoint, the largest coal-burning plant on the Island is operated by the ESB, which is identifying alternative sources for future coal deliveries in the context of the EU’s ban on importing coal from Russia. Since the ban, the majority of Irish coal imports have come from Colombia or Poland.

4. Electricity Emergency Management

When the potential loss of a single generator/interconnector could lead to insufficient electricity generation to meet demand, an Emergency State will occur. This occurs when there is a high risk of failure in meeting system demand or when operational limits are violated. During this Emergency State, EirGrid may have to reduce or cut off supplies of electricity to some consumers, this includes a mandatory demand curtailment process which reduces the demand of large energy consumers, including those who operate with backup generators.

2022 Winter Lookahead

The anticipated peak demand for the coming winter period is between 5456MW and 5786MW, this would exceed the previous record set on 8th of December 2021 of 5391MW.

De-rating factors are applied to the generation capacity of Ireland’s available generating units, this reflects the contribution of each generator to capacity adequacy. The de-rating factor for a conventional dispatchable generating unit is generally based on forced outage rates in a rolling three-year period.

The de-rated margin is the sum of the de-rated generation capacity from all available generating units and interconnectors, less the forecast demand and reserve requirements. A positive de-rated margin means there is a greater likelihood that we will have sufficient capacity to meet demand, while a negative margin indicates a shortage in generation capacity.

EirGrid has stated a de-rated margin of -9MW for the coming winter period which indicates that the system is very tight this winter and there is a risk of a shortage of power.

Long-Term Considerations for the Future of Energy Security of Supply

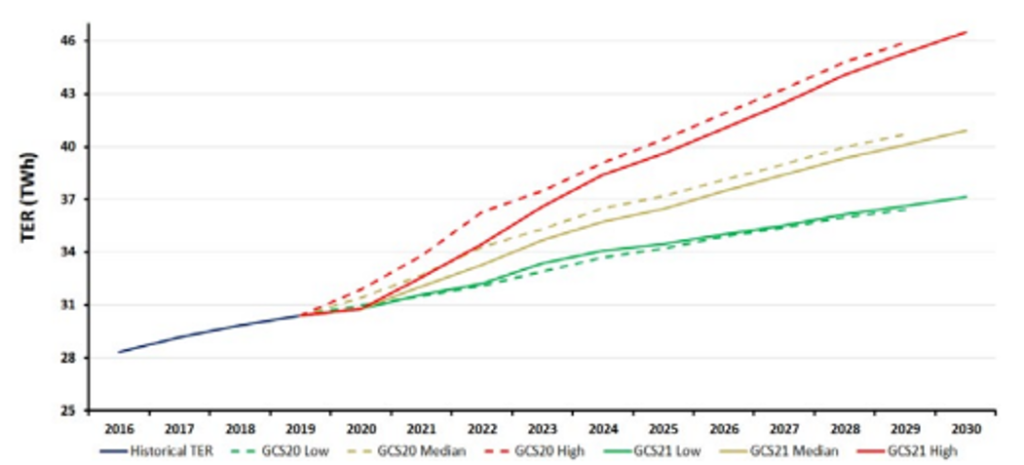

- Figure 4. Ireland Total Electricity Demand Forecast (EirGrid)

EirGrid’s Generation Capacity Statement considers the balances between electricity demand and supply during the years 2021-2030. There are plans for newer, cleaner gas-fired plants to replace ageing plants being retired due to the transition to low-carbon and renewable energy.

The statement concludes that:

- The electricity industry will have to find new ways to meet the increasing need for energy without relying mainly on burning fossil fuels.

- New government policies are expected to help guide us away from fossil fuels toward alternative heating methods, such as electric heat pumps, and cleaner modes of transport, such as electric vehicles.

- This changing demand and generation supply landscape for the island will require coordinated management of both the volume and type of new capacity, alongside new ways of managing increasing demand to ensure the security of supply.

- To prepare for this change, EirGrid must make the electricity grid stronger and more flexible. Given the scale of change, there is a need to plan for a lot of new grid infrastructures – such as underground cables, pylons and substations.

- The Irish electricity ecosystem supported by EirGrid is at the vanguard of delivering a cleaner, affordable and secure supply of electricity for consumers in both jurisdictions. Mapping the island’s electricity needs is an important feature of our work; it helps our governments, regulators and industry to prepare for the future.

In short…..

Generation deficits are set to increase in the short term due to the deteriorating availability of power plants, with EirGrid’s winter lookahead stating a de-rated margin of -9MW, which is indicative of a shortage of generation capacity in times of crisis. However, looking past this winter, the generation deficit is expected to reduce in the long term, as new generation capacity is added, and the grid enhanced.

Long-term structural changes need to be made to meet the forecasted rise in electricity demand. With plans to increase the percentage of renewables in the mix for the long term, the increased indigenous production will reduce Ireland’s reliance on imports, and further bolster energy security on the island.

Article written by Jack Atkinson

If you would like to speak to ElectroRoute about our services, please email us at info@electroroute.com

About ElectroRoute….

ElectroRoute, a subsidiary of Mitsubishi Corporation, is a renewable-focused energy trading company, offering our services in Europe and Japan. For more information on our services, click this link.