The Evolution of Energy Storage Trading Strategies

The Evolution of Energy Storage Trading Strategies

Following a successful innaugural Energy Storage Ireland Conference this week, our latest Insight builds upon the theme of our presentation at the conference by Brian Kennedy, Head of Trading Solutions at ElectroRoute. Specifically, we examine the nature of transition in revenue for energy storage assets on the island of Ireland.

Revenue Model Evolution

Traditionally, energy storage projects have focused on the 3 standard revenue streams, being;

i) system service revenue,

ii) capacity market revenue, and

iii) energy market revenue.

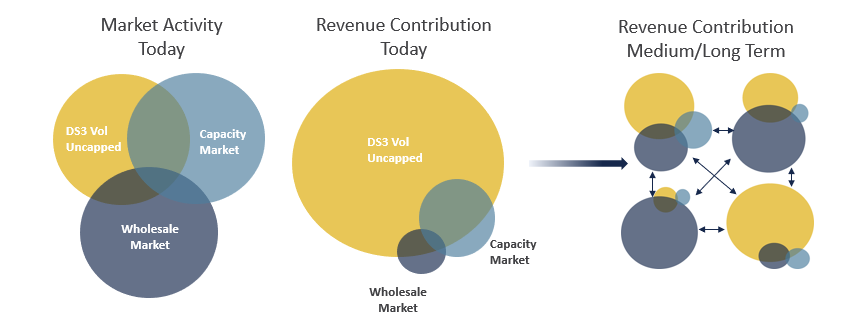

We have seen that the contribution of revenues today is strongly weighted towards system services, with DS3 revenue making up a significant percentage of the overall pot of revenue for a battery system.

The recent announcements of a review of the DS3 tariffs has led to an understandable focus around what the future looks like and how revenues will be weighted going forward. Taking account of our experience in other markets, we see that whilst competition may lead to an overall reduction in ancillary services revenue, more focus should be given to the nature of the transition and opportunity in other areas.

It is likely that as a result of the rapid evolution of the power sector, the value drivers for storage will continue to be transient and likely move in shorter windows between energy arbitrage to ancillary services and from one system service to another.

Figure 1: Energy Storage Revenue Diversification

Staying Ahead of Change

It is understood at the moment that the ancillary services regime will move to a competitive procurement model from around 2024, however it is important to recognise this milestone as the starting point in the transition. From this point, competition and liquidity will drive new revenue dynamics for all participants, and the renewable integration on the system is likely to result in the implementation of new or tweaked services which respond to the system challenges presented as a result.

It remains imperative therefore that storage assets being designed today are done so in a manner which allows the unit to take advantage of new revenue opportunities as they arise.

Specifically, this means batteries that can cycle regularly and have adequate storage duration to respond to reserve/wholesale market opportunities.

This is equally true of the trading strategies which should be future proofed to ensure a seamless transition to capture new revenue opportunities.

New Revenue Opportunities

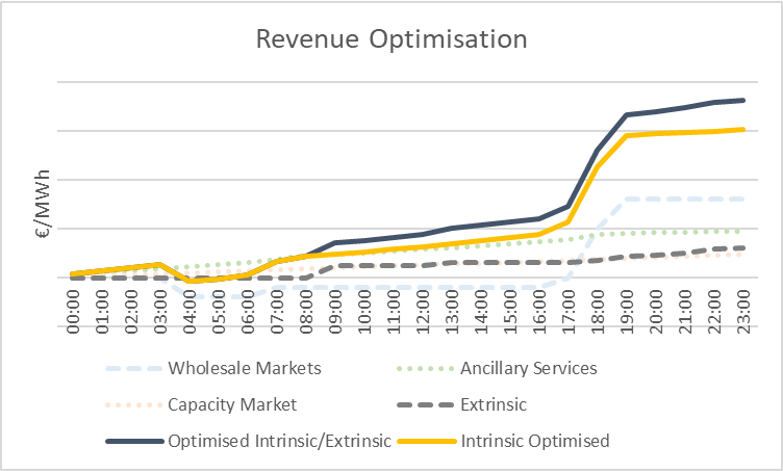

An area of focus for ElectroRoute is also around the opportunity to find new revenue opportunities for storage assets. It is likely that such opportunities, be they demand firming, portfolio management or supporting carbon accounting agendas, will be characterised by low liquidity and accessed by bilateral contracting rather than by tradition registrations to a marketplace. We refer to these as extrinsic revenues and assume their access will be driven by trading houses primarily.

The challenge for the storage sector and trading businesses such as ElectroRoute is to monetise such revenues whilst also mitigating the likelihood of a lower level of certainty to the revenue model.

The illustrative example below in figure 2 shows interlinking of revenues with extrinsic value with intrinsic revenues (capacity, energy, ancillary services) for a potential optimisation of revenues.

Figure 2: Energy Storage Revenue Optimisation

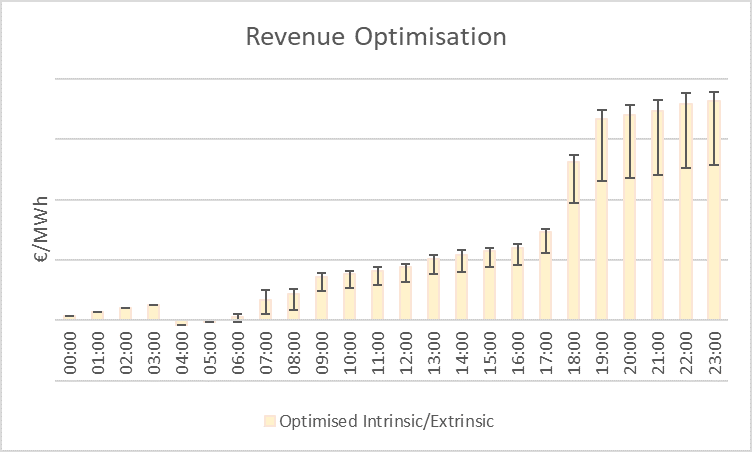

It is important to note that the optimisation approach to energy storage business models is not without risk, and the movement of value across different services and markets means investor returns may no longer be underpinned by stable regulatory tariffs. The movement away from revenue certainty results in a greater focus on the trading house, such as ElectroRoute, to warehouse these risks and provide bespoke solutions to battery asset owners which provide some level of security and certainty.

Figure 3: Volatility in revenue capture

The nature of this risk potentially opens a requirement for trading entities to provide tolling style agreements, that offer energy storage assets a fixed price in return for high availability.

If you would like to speak to ElectroRoute regarding our Trading Solutions for energy storage projects in Ireland, please contact brian.kennedy@electroroute.com