(Inter)connecting the dots on future Brexit arrangements

(Inter)connecting the dots on future Brexit arrangements

On 1st January 2021, the Brexit transition period will end and the UK will irrevocably cut any last remaining ties to the EU and head out to forge its own future, with or without a trade agreement in place. Many energy market participants may feel understandably uncertain about what this landmark political milestone will mean for their day-to-day business, particularly with the possibility of a last-minute deal still on the table. In this Insight, we pull together the various decisions and alternative arrangements that will come into effect from the start of 2021 to provide a clearer picture of what the energy market will look like.

Too late in the day (ahead)

The consensus from the various market operators is that even if there is an agreement made before the end of 2020, it is too late to update systems and implement the new deal before the transition period ends, except in the case that the EU agree to let GB participate in the energy markets exactly as they do now. Consequently, the GB zone will be decoupled from the European Internal Energy Market in January.

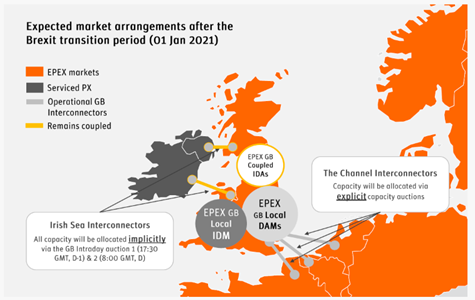

In practice, this means that the interconnectors serving GB will cease to use the Harmonised Allocation Rules and no longer be part of the Single Day Ahead Coupling [1]. In order for these interconnectors to still serve a purpose, alternative arrangements have been put in place.

Fig. 1. The expected market arrangements after the Brexit transition period (Taken from [1])

The Channel interconnectors (IFA, BritNed and NEMO) will now have capacity allocated via explicit capacity auctions [1] and will create a new set of Allocation Rules. Market participants successful in acquiring capacity in these auctions will be required to nominate that capacity or they will forfeit the right to use it, similar to the process that was previously ongoing in SEM through the Long Term and Intraday allocation timeframes. Another interconnector, IFA2, is currently commissioning and will be available for trading in the near future.

The Irish Sea interconnectors (Moyle and EWIC) will not be available in the SEM day-ahead market – effectively leaving the Irish market decoupled from Europe at this point. They will however be available in the Intraday 1 & 2 auctions, which will still couple the GB and Irish markets and allocate capacity on the two interconnectors implicitly [1]. All FTRs sold on the interconnectors will be reimbursed on the initial price paid for them, in accordance with Article 27 of the EU Guideline on Forward Capacity Allocation [2]. SEMO has indicated that no transmission rights products will be sold in the short-term until a new product offering is known [3].

Will the SEM markets Remain strong?

How the SEM markets change depends a lot on how market participants react to the new arrangements. The current expectation is that the magnitude and volatility of day-ahead prices will increase, and that there will be more liquidity in the intraday markets as they become the only markets in which Irish participants can exchange power with Britain. However, this assumes that British participants are as willing to trade in the comparatively smaller Irish market as their Irish counterparts. Equally, Irish participants might want to avoid uncertainty at intraday (which has seen much lower traded volumes than day-ahead since the beginning of ISEM) and may continue to trade primarily at day-ahead to secure their positions.

Not what we’re a-Customs-ed too

The lack of a trade agreement would also mean that declarations will need to be made on the import/export of goods between Ireland and GB. Westminster have stated that goods travelling from Northern Ireland to GB will not require declarations, but the EU insists that any goods imported to Ireland north or south and continental Europe will. In the case of power and gas flows, declarations will be made on behalf of market participants by the interconnector or pipeline operator [3], [5].

Better get EUsed to it

The new arrangements are likely to cause some disruption come January as participants find their feet in the new world, and this confusion combined with tight generating margin this winter [5] could lead to some unexpected market outcomes. In the long-run, inefficient interconnector flows will likely lead to larger wind curtailment levels during periods of high wind when Ireland would usually export, and more expensive wholesale electricity prices during traditional import periods as higher priced conventional power is called on in place of imports from GB, both of which could increase Ireland’s greenhouse gas emissions and make it more difficult to meet our 2030 targets.

A key consideration is that unless a last-minute deal allows GB to participate in the European energy markets exactly as it does now, these measures will come into effect in January 2021 – at best temporarily, until new arrangements struck under a deal can be implemented, or at worst permanently. Preparing now to manage these new risks and becoming familiar with the market changes will help your business make the transition to a post-Brexit world as seamless as possible.

Please contact our Client Services team at clientservices@electroroute.com if you would like to explore the hedging, trading, forecasting and balancing services that ElectroRoute can offer to manage new risks your business may face as a result of Brexit.

References:

[1] EPEX SPOT info, EPEX, 16th October 2020

[3] Energy EU Exit Stakeholder Event, Department for the Economy, 11th September 2020

[4] Nordpool announces GB Auction changes for Brexit, Nordpool, 19th Oct 2020

[5] Market Operator User Group, SEMO, 8th October 2020