Battery Storage – Project Development in an Evolving Marketplace

Battery Storage – Project Development in an Evolving Marketplace

In the first of our series of Insights revolving around the battery storage sector on the island of Ireland, we explored the market for batteries at present. The DS3 arrangements are the focus for revenue capture at the moment for battery sites given the attractive DS3 regulated tariffs and reasonably low barrier to entry. However, we noted a point of caution; DS3 is not providing long term certainty and beyond April 2023, if not before, the market opportunities become more opaque.

In this Insight, we explore how the likely future reduction in DS3 rates will lead project sponsors to shift their risk appetite towards energy markets. An integral piece of this shift in business model will be design capabilities of the battery.

DS3 – Here today, but what of tomorrow?

We know that DS3 regulated tariffs are reasonably secure until around 2023, assuming that the tariffs are not reduced before. The maximum allowable budget for DS3 is €235mln per annum. Where this budget looks likely to be breached, or where EirGrid have procured more services than required, the regulated rates can be re-evaluated downward prior to 2023.

Beyond 2023, the DS3 contracts allow for two extensions of 18 months where deemed required by EirGrid. In the recent SEM Committee Scoping Paper on the future of system services, the following is stated;

“There is scope to extend the current contracts by two periods of 18 months. The RAs [Regulatory Authorities] may exercise this option should any issues arise which delay the implementation of a new framework”.

We expect the extension of these contracts to be subject to approval depending on the state of succeeding services programmes.

If we look to our neighbouring markets, we see that there is a likelihood for revenue markets to move and ebb and flow constantly. In Great Britain, we’ll soon see the movement away from Firm Frequency response to new products. In Germany and surrounding markets, the Operating Reserve markets have undergone market changes, now trending to shorter duration auction windows. At home, the SEM Committee have already initiated a scoping exercise on the future system services arrangements. It is clear therefore that keeping a project positioned in numerous revenue markets to stay ahead of this dynamic situation is of paramount importance.

Regulatory policy drives near term battery design

We’ve recently seen the CRU recognise the need to abolish double charging for network usage for battery technology. This raises the question; is a battery considered generation, supply or neither? It’s not a simple answer and hence the CRU have implemented an Interim Solution on Network Charging whilst the area is considered and a path forward developed.

The interim solution is to charge for network usage on the basis of Demand TUoS. This has the effect of incentivising asymmetric connections to the power system. In other words, batteries will look to reduce their Maximum Import Capacity whilst maximising Maximum Export Capacity. The battery can then optimise its DS3 provision and minimise its operating costs via reduced network charges. This makes sense today. However, as we’ve noted above, DS3 revenues are not set in stone for the lifetime of a battery installation, so this solution has the impact of slowing the rate of charge to replenish battery stores on the island.

In a world where arbitrage and system balancing becomes an important revenue possibility and system tool, how does this impact the potential for the battery installation?

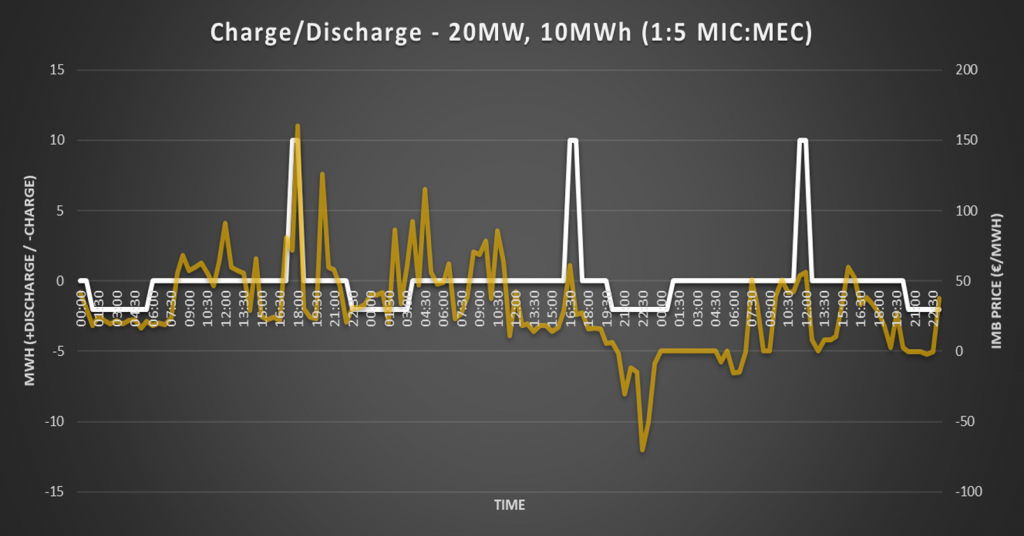

We can see in the figure below, a battery installation with a MIC:MEC of 1:5. We can see the time taken to charge after a full discharge is therefore almost linearly extended. Given that the unit requires this long to charge, it is highly unlikely the unit can avail of spreads within the daytime hours.

Consider this situation in an arbitrage model. The project is effectively limited to one cycle a day.

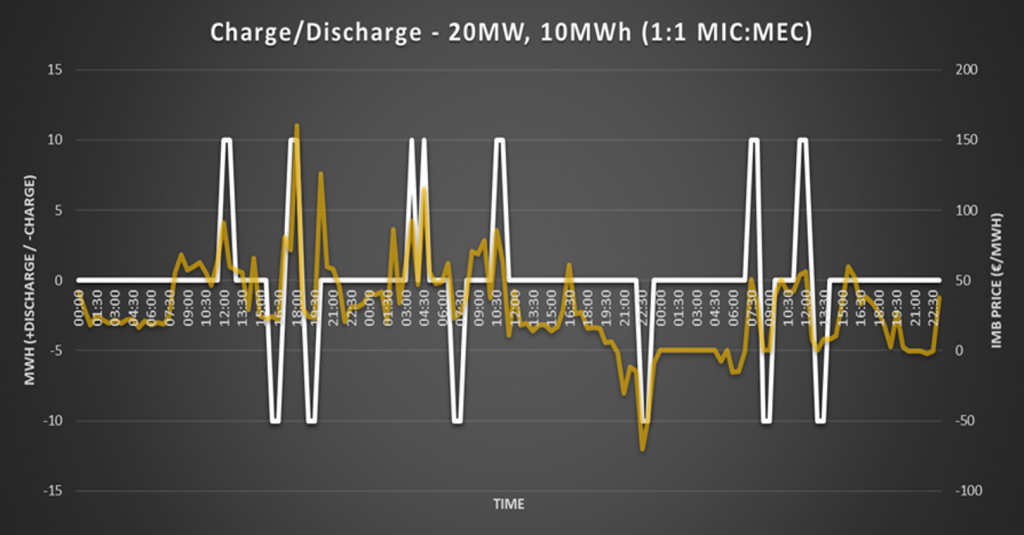

Were the unit to have a symmetric MIC:MEC, the opportunity for the battery to react more readily to system conditions is clearly apparent. This is highlighted in the graphic below. Note that these are highly illustrative examples and not considering other factors such as warranty limitations on cycling.

Not only do we consider the charge rate when assessing the capability of a battery to support system balancing, the duration of the battery is a clearly important metric.

The vast majority of batteries under development are in the range of 25-35minutes of useful life at full discharge. Again, the capability of a battery to contribute to an extended event, such as a major plant outage or a low wind period, is somewhat limited where the battery is constrained to such durations. We see the market developing towards 2-hour plus durations, however this is largely driven by the cell costs of batteries, and equally the assurance that the market signals such as negative pricing remain in place and are not otherwise dampened through regulation..

Business Models – Constant evolution

Given we know that the route to market which is available today for battery technology in Ireland will rapidly develop to create more optionality to project sponsors in the future, it’s important to plan for this future.

ElectroRoute has been engaging directly with project sponsors to develop a route to market for battery technology based on the commercial prospects and associated route to market requirements of the day, however while keeping an eye to the future and ensuring our framework enables the battery to optimise its revenue and adequately manage risk as the market continues to develop.

If you would like to speak to ElectroRoute regarding our Trading Solutions for energy storage projects in Ireland, please contact brian.kennedy@electroroute.com